Germany: the perfect storm

Russia continues to threaten its gas deliveries, now with the temporary halt of Nord Stream 1 as of the 31 August. Germany finds itself in the heart of the European energy crisis with 7.9% year-on- year inflation in August and recession in the pipelines. The DAX has suffered heavily on European equity markets this year. On a more long term view, however, the German economy could present some interesting opportunities, but patience will be required.

Recession in the pipelines

The German economy is currently facing a number of major headwinds: a massive supply shock linked to its exposure to Russian energy and a badly timed demand shock from major trading partners due to the slower-than-expected reopening of China and an expected Fed-induced slowdown in US demand. Industrial production made a modest recovery in June (up 0.4% Month-on-Month) as manufacturing backlogs as supply bottlenecks improved slightly. However, on the demand side, retail sales fell sharply by 1.6% MoM. Nevertheless, Germany’s trade surplus is fading rapidly as commodity prices cause imports to surge (25% Year-on-Year), far surpassing the recovery in exports (15% YoY).

Inflation saw some relief in June and July, but rose by 4 basis points in August (7.9% YoY), mainly due to higher food prices. The end to temporary government price caps on transport and fuel end of August will be a source of price pressure as of September. The labour market as a whole continues to be stable. Wages increased by 4% YoY in Q1 2022. The rise in the unemployment rate in July (to 5.4%) is once again prompted by Ukrainian refugees registering for work. Nevertheless, survey data depicts the extreme levels of uncertainty surrounding the energy crisis dampening investment prospects. Furthermore, contrary to Q2 2022, private consumption will no longer benefit from the end of lockdowns in Q3.The IFO Business Climate Index fell into recession territory at 88.5 points in August (down from 99 in February), while the GFK consumer survey is well below March 2020 levels. The pace of job creation is also slowing in surveys.

The possible decision by Russia to stop gas deliveries is a severe threat to the entire economy. According to the Bundesbank, this could potentially shave -1.4 percentage points off growth in 2022 and 5.6 in 2023. Again this is bad timing, as German exporters are beginning to recover with: i) the gradual reopening of the Chinese production chain which and ii) the weakness in the euro that slightly cushions the impact on German competitiveness from the recent spike in producer prices (+37% YoY in July).

European equities: contingency planning

Germany has suffered heavily on European equity markets Year-to-Date: the DAX is down 19% and the MDAX (with a high exposure to the German economy) is down 28%. The current environment of extreme uncertainty and increased recession risks calls for an increase in underweight in European (and notably German) equities, despite this already stark correction. Over the summer, the DAX benefitted from the recent bear market rally, but heightened hawkishness from the Fed and the ECB combined with fresh gas cuts has dragged the index back to July lows.

Given its international exposure, the DAX could benefit in the short term from the weak euro (below parity with the USD end August) or any good news on Russian gas imports, but volatility will remain high and event-driven. In contrast, green investment areas should witness in the coming year dynamic capex growth supporting future earnings growth.

Transforming challenges into growth opportunities

In the midst of uncertainty, Germany indeed hosts a number of sources of future growth. Its low public debt level, negative real interest rates, along with the weakness of the euro and political stability should help the economy go through the major transitions ahead.

Higher fossil fuel prices a further catalyst towards cleaner energy

Even before the Ukraine war, energy reforms took centre stage in Germany. However, German industry remains very gas-intensive, particularly the automotive and chemical sectors. To deal with the risk of shortage, Germany has been forced to reignite coal-fired power plants thereby pushing back its greenhouse gas emissions neutrality after 2035. It is also planning a significant push in liquefied natural gas (LNG) solutions: an increase in LNG imports, EUR 200 billion by 2026 on charging infrastructure, hydrogen technology and modernisation of industry, EUR 3 billion for the acquisition of four FSRUs (Floating Storage Regasification Unit) and EUR 500 million in the construction of an LNG terminal - a boon for builders of this type of infrastructure.

Furthermore, on 8 July the Parliament announced its largest expansion plan for renewable energy. The road-map foresees: streamlining laws, doubling Germany’s onshore wind power capacity (to 115 GW), tripling the solar energy (to 215 GW) and expanding the offshore wind energy (to 30 GW) by 2030.

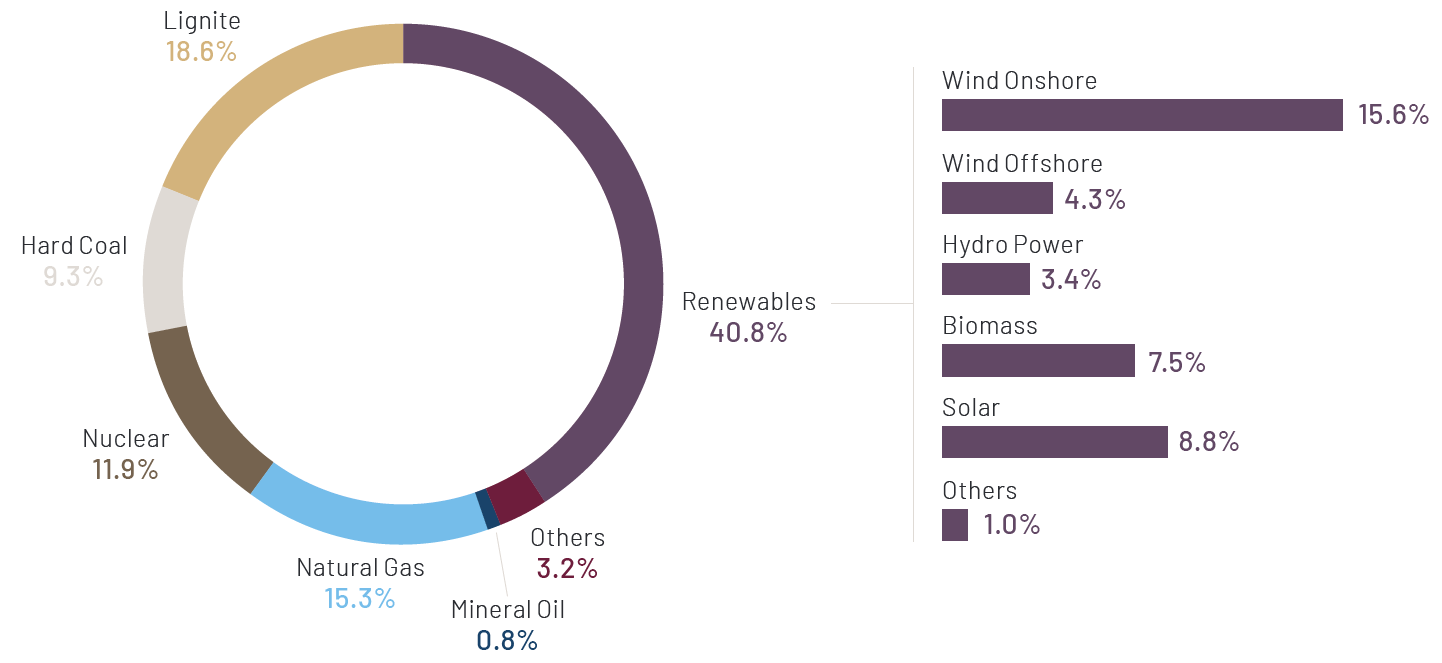

The new target is to produce 80% of its energy from renewable power by 2030 (41% today, Chart 1). Corresponding infrastructure investments are expected to be announced, but the grey area remains the intermittent nature of renewable energies and storage technologies, which today accentuates reliance on gas in the winter season.

A new military investment fund

Finally, after the assault on Ukraine, Germany committed to meeting the NATO demand of a 2% GDP target for military spending in 2024 (the cap was at 1.5%). The EUR 100 billion military modernisation fund was validated mid-July. Germany’s official list of military investment is secret and will be constrained by short term supply chain issues, but US/German defence companies and Northern Germany’s shipyards hope to benefit from these new investment needs.

Chart 1: share of energy sources in gross German power production, 2021, %

Source: BDEW-German Association of Energy and Water Industries, Indosuez Wealth Management.

August 31, 2022